The FAssets system, developed by Flare Labs, allows non-smart contract tokens such as XRP, BTC and DOGE to be used trustlessly within smart contracts on Flare.

Why

More than 70% of the total value of blockchain assets do not have smart contracts and are therefore unable to participate in the decentralized economy. By minting these non-smart contract tokens into FAssets, you will be able to put them to work earning yield or rewards in decentralized applications on the Flare network. Once the FAssets are on Flare, you will be able to bridge them to other networks via LayerCake.

How

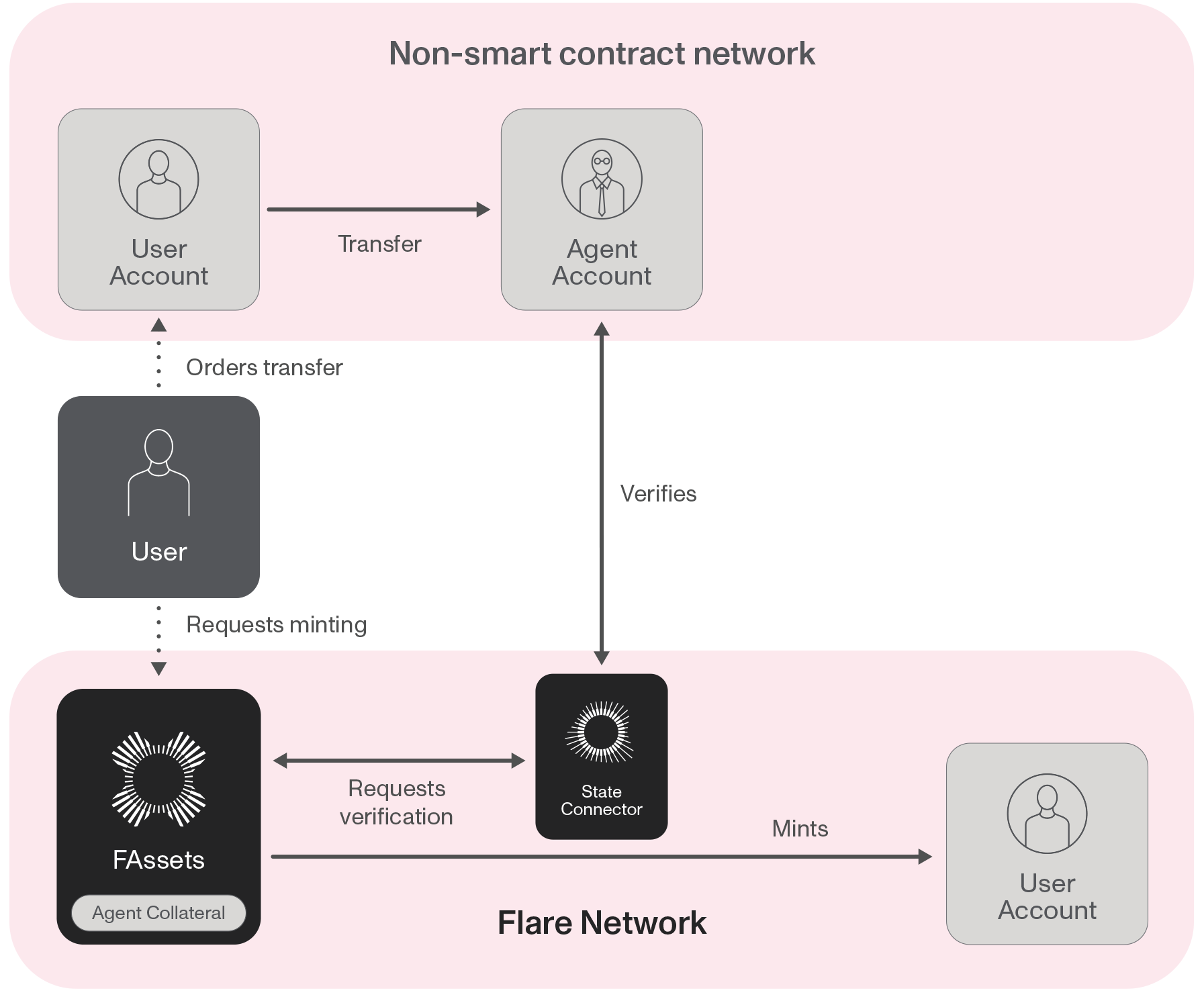

The FAssets system is enabled by Flare’s data acquisition protocols, the State Connector and Flare Time Series Oracle. The FTSO provides decentralised price feeds for all the tokens involved, and the State Connector can verify that a required action has taken place on a different chain.

Each FAsset will be backed by mixed on-chain collateral held by an agent and in a community provided pool. This backing consists of three asset types: the underlying, stablecoin or ETH collateral, and Flare native token collateral, FLR or SGB. The minting and redeeming process will be supported by a number of agents. Their role in the system is secured through over-collateralization, such that the system is rendered trustless.

Someone who wishes to mint FAssets starts by selecting an agent and paying a small fee to reserve the required collateral. The minter then sends the agent the underlying asset, with the State Connector used to prove the transaction has taken place on the other chain. With the payment verified, the FAssets are then minted as ERC-20 tokens on Flare. These tokens can be used within DeFi on Flare or bridged to another chain.

FAssets enable smart contracts for tokens without them.

FAssets enable smart contracts for tokens without them.